🚀 Need content that brings clients?

I help small businesses create authority-building content that converts.

👉 Explore Services

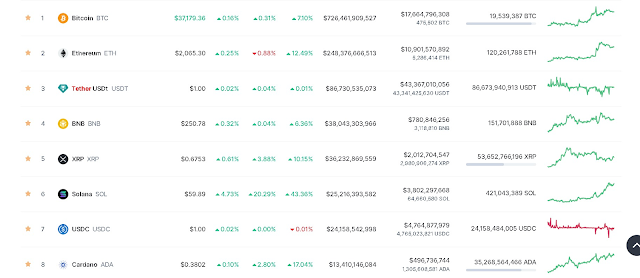

The success of cryptocurrencies has garnered a wide range of opinions and comments from people. Here are some common sentiments and observations associated with cryptocurrency success:

Financial Opportunity

Many individuals view cryptocurrencies as a significant financial opportunity. They have seen the value of cryptocurrencies like Bitcoin and Ethereum rise over the years and believe in the potential for substantial returns on investment.

Decentralization and Freedom

Supporters of cryptocurrencies often emphasize the idea of decentralization. They appreciate the removal of intermediaries like banks and governments from financial transactions, which they see as a way to empower individuals and increase financial freedom.

Technological Innovation

Cryptocurrencies are seen as a testament to technological innovation. Blockchain technology, which underlies most cryptocurrencies, is regarded as a groundbreaking advancement in secure and transparent record-keeping.

Financial Inclusion

Cryptocurrencies have the potential to bring financial services to people who are unbanked or underbanked. This inclusivity is celebrated as a way to improve global financial access and reduce disparities.

Hedging Against Inflation

In regions with high inflation, cryptocurrencies offer a means to hedge against the devaluation of local currencies. People often turn to cryptocurrencies as a store of value in such circumstances.

Skepticism and Caution

Not everyone is convinced of the long-term success of cryptocurrencies. Many critics express skepticism about their stability, the potential for regulatory challenges, and concerns about price volatility.

Regulatory Concerns

Concerns about government regulations and taxation in the cryptocurrency space are prevalent. People worry about how governments might impact the use and growth of cryptocurrencies.

Volatility

The extreme price volatility of cryptocurrencies, where values can fluctuate significantly in a short period, is often mentioned. While some see this as an opportunity for profit, others find it concerning.

Scams and Risks

The cryptocurrency market has also been associated with scams, fraud, and hacking incidents. Some individuals caution against investing without understanding the risks and conducting proper due diligence.

Environmental Concerns

The environmental impact of cryptocurrency mining has raised concerns due to the energy-intensive process required for securing blockchain networks.

Mainstream Acceptance

The fact that cryptocurrencies are gaining acceptance among mainstream financial institutions and major corporations is acknowledged as a significant step in their success.

Market Speculation

Many people view the cryptocurrency market as driven by speculation, with the fear of missing out (FOMO) often motivating investments.

In summary, the success of cryptocurrencies is a subject of both enthusiasm and debate. While some people see them as a revolutionary force with the potential to reshape the financial landscape, others approach them with caution due to various risks and uncertainties. Public opinion about cryptocurrencies can be highly polarized, and individual perspectives often depend on their own experiences and beliefs about the future of finance and technology.

Switzerland has been a leader in the cryptocurrency and blockchain space for several reasons:

Regulatory Clarity

Switzerland has established clear and supportive regulations for cryptocurrencies and blockchain technology. The Swiss government, along with the Swiss Financial Market Supervisory Authority (FINMA), has provided guidelines and legal frameworks that offer both security and flexibility for blockchain and cryptocurrency projects. This regulatory clarity has attracted businesses and investors to the country.

Strong Financial Sector

Switzerland has a long-standing reputation as a global financial hub. The presence of a well-developed financial sector and banking industry provides a solid foundation for cryptocurrency-related activities, including custody, trading, and investment services.

Crypto-Friendly Environment

The country's crypto-friendly environment is reinforced by its low taxes and business-friendly policies. Startups and established companies in the cryptocurrency and blockchain space find Switzerland an attractive destination for their operations.

Innovation and Education

Swiss universities and research institutions actively engage in blockchain and cryptocurrency research. The country's commitment to innovation and education has helped foster a culture of understanding and development in this field.

Blockchain Ecosystem

Switzerland boasts a thriving ecosystem of blockchain startups, organizations, and events. Notably, the city of Zug, often called "Crypto Valley," has become a global hub for blockchain innovation, attracting entrepreneurs and investors from around the world.

Stability and Security

Switzerland is known for its political stability and strong legal system, which instills confidence among investors and businesses in the cryptocurrency space. The country's tradition of privacy and security aligns well with the principles of decentralized technologies.

Proximity to International Hubs

Switzerland's strategic location in the heart of Europe makes it easily accessible to other major financial and technological hubs in the region. This geographic advantage contributes to its appeal to international blockchain and crypto projects.

Collaboration

between the public and private sectors has been instrumental in fostering cryptocurrency innovation in Switzerland. The government and industry stakeholders have worked together to create a favorable environment for blockchain and crypto development.

These factors, combined with Switzerland's reputation for stability and innovation, have positioned the country as a leader in the cryptocurrency and blockchain space. It continues to attract entrepreneurs, investors, and businesses looking to leverage the advantages of this supportive ecosystem.

The future financial system and its safety

The future financial system with cryptocurrency has the potential to offer several safety and benefit advantages to individuals:

Security and Transparency

Cryptocurrencies operate on blockchain technology, which is known for its security and transparency. Transactions are recorded on an immutable public ledger, making fraud and manipulation difficult. This can provide individuals with greater confidence in the integrity of financial transactions.

Reduced Counterparty Risk

Traditional financial systems involve intermediaries, such as banks and payment processors. Cryptocurrencies, as decentralized systems, reduce counterparty risk. Users have direct control over their assets and don't rely on a third party to complete transactions.

Financial Inclusion

Cryptocurrencies have the potential to provide financial services to unbanked and underbanked populations. People in regions with limited access to traditional banking can use cryptocurrencies to access a global financial system.

Lower Transaction Costs

Cryptocurrency transactions can be more cost-effective compared to traditional banking, especially for international transfers. This can save individuals money when sending funds across borders.

24/7 Accessibility: The cryptocurrency market operates 24/7, allowing individuals to access and use their digital assets at any time. This can be particularly valuable for international travelers or those needing financial services outside of regular banking hours.

Ownership and Control

With cryptocurrencies, individuals have full ownership and control over their digital assets. This eliminates the risk of frozen accounts or asset seizure by third parties.

Privacy

While not all cryptocurrencies provide complete anonymity, they often offer a higher degree of privacy compared to traditional financial systems. This can be important for those who value financial privacy.

Financial Empowerment

Cryptocurrencies give individuals more direct control over their financial affairs. They can choose how and where to store and invest their assets, empowering them to make their own financial decisions.

Global Access

Cryptocurrencies are accessible to anyone with an internet connection, offering financial services to a global audience. This is especially beneficial for those in regions with limited access to traditional financial institutions.

Innovation and Choice

The cryptocurrency space is a hotbed of innovation. It continually offers new financial products and services, providing individuals with more choices and opportunities for investment and wealth management.

Financial Education

Cryptocurrency adoption encourages individuals to become more financially literate. As people engage with digital assets, they learn about technology, economics, and investment, which can have broader educational benefits.

While cryptocurrencies offer many potential advantages for the future financial system, it's important to note that they also come with risks, including price volatility, regulatory uncertainties, and security concerns. As technology continues to evolve and mature, the financial system can become safer and more inclusive, ultimately benefiting people worldwide. However, it's essential to approach cryptocurrency usage with caution, conduct thorough research, and consider individual financial goals and risk tolerance.

Several countries around the world have been actively investing in cryptocurrencies and blockchain technology, with the goal of leveraging these innovations to benefit their economies. Here are a few examples of countries and how they are supporting the cryptocurrency and blockchain industry and its potential economic impact:

Top Countries Leading in Cryptocurrencies

United States

The United States has shown increasing interest in cryptocurrencies and blockchain technology. While regulatory clarity is still evolving, various states, such as Wyoming and Miami, have taken proactive steps to create a favorable environment for blockchain businesses. These developments have attracted investment and talent to the country, potentially boosting economic growth and innovation.

China

China has been actively developing its digital currency, the Digital Yuan (CBDC), and is conducting pilot programs to test its use. The Chinese government sees the Digital Yuan as a way to improve the efficiency of its financial system, reduce the reliance on traditional banks, and potentially expand its influence in international trade and finance.

Switzerland

As previously mentioned, Switzerland has positioned itself as a global hub for cryptocurrencies and blockchain, particularly in the city of Zug, known as "Crypto Valley." The Swiss government's regulatory support, along with its strong financial sector, has attracted businesses and investors, contributing to economic growth and innovation.

Estonia

Estonia is often seen as a leader in digital governance. The country has explored blockchain technology for various applications, including e-residency and secure data management. These efforts can improve government efficiency and attract foreign investment.

Singapore

Singapore is known for its blockchain-friendly regulations and support for fintech innovation. The government has invested in blockchain research and development, attracting startups and talent. These initiatives contribute to Singapore's reputation as a global fintech hub.

United Arab Emirates

Dubai, in particular, has been actively exploring blockchain and cryptocurrency adoption, aiming to become a blockchain-powered smart city. The government's initiatives in blockchain technology, coupled with favorable regulations, can attract investment and stimulate economic growth.

Germany

Germany has shown interest in blockchain and is exploring its potential applications in various industries, including finance and supply chain management. These efforts are expected to enhance efficiency, reduce fraud, and stimulate economic activity.

Malta

Malta has actively positioned itself as the "Blockchain Island" by enacting a comprehensive regulatory framework for blockchain and cryptocurrency businesses. The government's support has attracted numerous crypto companies and investments.

Countries investing in cryptocurrencies and blockchain technologies often aim to achieve various economic benefits, including:

Innovation:

By fostering an environment for blockchain startups and tech companies, these nations encourage innovation, leading to the creation of new products, services, and business models.

Job Creation

The growth of the cryptocurrency and blockchain sector results in job opportunities and the development of a skilled workforce.

International Investment

Favorable regulatory environments can attract foreign investment and talent, leading to economic growth.

Efficiency

Blockchain technology can improve efficiency and transparency in various sectors, reducing costs and increasing productivity.

Global Competitiveness

Countries investing in blockchain aim to stay competitive in the rapidly evolving digital economy and be at the forefront of emerging technologies.

It's important to note that while cryptocurrencies and blockchain have the potential to bring economic benefits, they also come with regulatory and security challenges that need to be carefully managed. Each country's approach to this technology may vary based on its unique goals and regulatory frameworks.

The future perception of cryptocurrencies

The success of cryptocurrencies has garnered a wide range of opinions and comments from people. Here are some common sentiments and observations associated with cryptocurrency success:

Financial Opportunity

Many individuals view cryptocurrencies as a significant financial opportunity. They have seen the value of cryptocurrencies like Bitcoin and Ethereum rise over the years and believe in the potential for substantial returns on investment.

Decentralization and Freedom

Supporters of cryptocurrencies often emphasize the idea of decentralization. They appreciate the removal of intermediaries like banks and governments from financial transactions, which they see as a way to empower individuals and increase financial freedom.

Technological Innovation

Cryptocurrencies are seen as a testament to technological innovation. Blockchain technology, which underlies most cryptocurrencies, is regarded as a groundbreaking advancement in secure and transparent record-keeping.

Financial Inclusion

Cryptocurrencies have the potential to bring financial services to people who are unbanked or underbanked. This inclusivity is celebrated as a way to improve global financial access and reduce disparities.

Hedging Against Inflation

In regions with high inflation, cryptocurrencies offer a means to hedge against the devaluation of local currencies. People often turn to cryptocurrencies as a store of value in such circumstances.

Skepticism and Caution

Not everyone is convinced of the long-term success of cryptocurrencies. Many critics express skepticism about their stability, the potential for regulatory challenges, and concerns about price volatility.

Regulatory Concerns

Concerns about government regulations and taxation in the cryptocurrency space are prevalent. People worry about how governments might impact the use and growth of cryptocurrencies.

Volatility

The extreme price volatility of cryptocurrencies, where values can fluctuate significantly in a short period, is often mentioned. While some see this as an opportunity for profit, others find it concerning.

Scams and Risks

The cryptocurrency market has also been associated with scams, fraud, and hacking incidents. Some individuals caution against investing without understanding the risks and conducting proper due diligence.

Environmental Concerns

The environmental impact of cryptocurrency mining has raised concerns due to the energy-intensive process required for securing blockchain networks.

Mainstream Acceptance

The fact that cryptocurrencies are gaining acceptance among mainstream financial institutions and major corporations is acknowledged as a significant step in their success.

Market Speculation

Many people view the cryptocurrency market as driven by speculation, with the fear of missing out (FOMO) often motivating investments.

In summary, the success of cryptocurrencies is a subject of both enthusiasm and debate. While some people see them as a revolutionary force with the potential to reshape the financial landscape, others approach them with caution due to various risks and uncertainties. Public opinion about cryptocurrencies can be highly polarized, and individual perspectives often depend on their own experiences and beliefs about the future of finance and technology.

💡 Want content like this for your business?

With 20+ years experience, I help brands grow with strategic content.

👉 Send Inquiry

⭐ Ready to turn your content into leads?

Let’s create a strategy tailored to your business goals.

👉 Start Your Project

.jpeg)