🚀 Need content that brings clients?

I help small businesses create authority-building content that converts.

👉 Explore Services

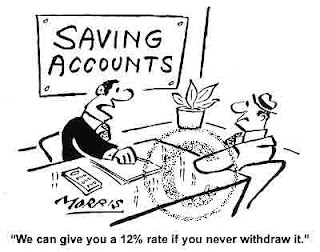

Saving Bank Accounts Definition

" A deposit account held at bank or other financial institution that provides principal security and a modest rate. Depending on the specific type of savings account, the account holder may not be able to write checks from the account (without incurring extra fees or expenses) and the account is likely to have limited number of free transfers / transactions. Savings account funds are considered one of the most liquid investments outside of demand accounts and cash. In contrast to savings accounts, checking accounts allow you to write checks and use the electronic debt to access your funds inside the account. Savings are generally for money that you don't intend to use for daily expenses to open a savings account, simply go down to your local bank with proper identification and ask to open an account."(Investopedia)

With excellent banking system operating both offline and online, there are thousands of customers opening their savings account everyday with the fact that banks are offering best interest rates and protecting the privacy of your funds.

Data protection, triple security layer and with many other funds security formats, banks provide heavy advantage to their customers.

But from consumer point of view, there are few points to make a note of while maintaining a savings bank account.

1.Have more Debit Cards or Credit Cards

Open savings account in more number of banks to be able to keep a track of your spending and saving. Credit card or Debit card, keep your cards in your wallet and use them for specific purposes. With the growing significance for plastic money, swiping cards is considered to be safe than keeping liquid cash.

2. Protect your Bank Details

Apps and mobile banking systems have generated user-id and passwords to login to your bank account. Since there is heavy traffic online, it is highly instructed to carefully login and logout during the time of transactions.

This measure of safety and security will safeguard your account and funds in a sophisticated manner. It is also recommended never to share your bank account number, user-id, password and mail-id with any third party.

3. Check Your Bank statements monthly

Going through the bank statements will enable you to verify and cross-check all your transactions. This measure of examination will give you more control over your transactions and you can also seek the support and assistance of bank staff.

4. Practice changing the password

Some banks allow and permit changing passwords that help you to login for mobile banking. Make sure to change the password and store it safely. Because login and password must be carefully preserved in order to make it more private to safeguard your savings.

Conclusion

As long as you safeguard and maintain the privacy of your savings bank account, you are doing great.

You can seek the assistance of bank staff to help you from time to time.

Recommended Reading:

You need a better bank 2015

World's Best Banks 2015

💡 Want content like this for your business?

With 20+ years experience, I help brands grow with strategic content.

👉 Send Inquiry

⭐ Ready to turn your content into leads?

Let’s create a strategy tailored to your business goals.

👉 Start Your Project

Tags

content